Ensure PCI compliance, reduce risk, and protect customer data with our expert-led PCI services.

Your annual PCI shouldn’t be a shot in the dark. Let experts confirm your compliance, close gaps, and keep your cardholder data safe.

Navigating PCI DSS requirements alone is risky. Incomplete SAQs, misinterpreted guidelines, and overlooked vulnerabilities can expose your business to penalties and compromise customer trust. With annual SAQs required, the margin for error is slim—and costly.

Our Annual PCI SAQ Confirmation service takes the guesswork out of compliance. We review your SAQ line by line, flag vulnerabilities, and help you understand exactly what to fix. With our expert guidance, your business can stay secure, compliant, and confidently ahead of threats.

You'll know exactly what you're paying every month. One-flat fee, no hidden charges.

Smooth and hassle-free setup to your existing MIS when you use Payably.

We'll design Payably to fit your brand and optimize customer experience.

All of Payably's software is set up for lower interchange rates to maximize savings.

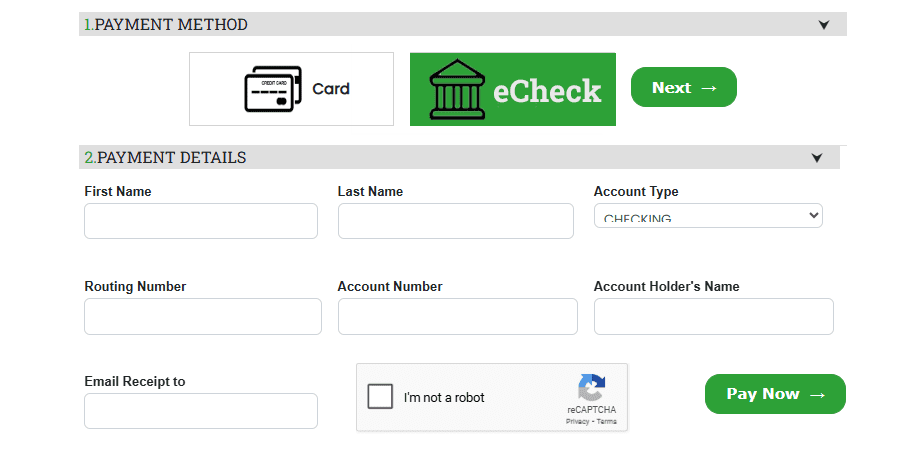

Using Payably, you can accept payments online, in-store, or over the phone.

You can securely set up automatic payments for recurring customers.

We provide hands on training to get you set up without disrupting your current services.

Every payment is tokenized to keep your customer data and transactions secure.

Our dedicated customer care team is with you every step of the way.

Switching to Payably will let you process payments faster, reduces errors, and makes things simpler for both you and your customers. With our software, you can offer more payment options, keep transactions secure, and even save on fees.

With our plugin you can easily connect with PrintSmith and start accepting payments — no hassle, just faster cash flow.

Not sure what your needs are? Need more information to make your decision? Our team is ready to answer all of your questions.

PCI stands for the Payment Card Industry. In 2006, major payment card brands Visa, MasterCard, American Express, Discover Financial Services, and JCB International established the Payment Card Industry Data Security Standard (PCI DSS). The PCI DSS helps merchants prevent consumer payment card data theft.

Compliance with the PCI DSS or “PCI DSS compliance,” is required for all businesses that process, store, or transmit payment card data. Merchants must complete a PCI DSS compliance form annually. Becoming PCI compliant helps prevent data breaches.

To get PCI compliant, you will need to first determine which self-assessment questionnaire (SAQ) you should follow. Depending on your SAQ, you will need to implement a set of requirements and controls as outlined in the PCI data security standard.

SAQ stands for self-assessment questionnaire. Depending on an organization’s card transaction volume and the types of transactions it performs, it may be able to use an SAQ to self-evaluate its compliance with the PCI Data Security Standard.

SAQs contain questions about card data security. SAQs range in size from 22 questions (SAQ A) to 329 questions (SAQ D).