5 Payment Automation Lessons Every Print Shop Owner Should Learn Before Year-End

Operations • Cash Flow • PrintSmith Vision

The print shop that thrives won’t be the one with the fastest press or the lowest prices. It will be the one that gets paid fastest. With margins compressed tighter than ever, the difference between waiting 30 days for payment and receiving funds in 48 hours isn’t a minor operational detail—it’s the foundation of financial stability.

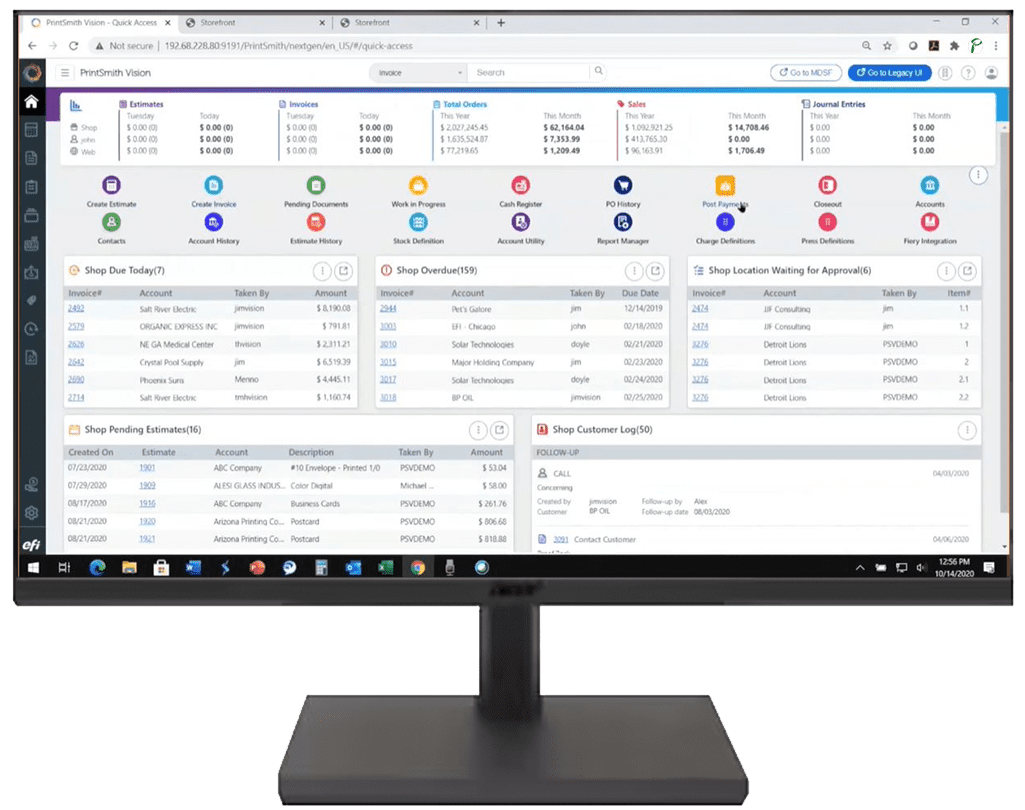

Over the past year, we’ve watched print shops across the country transform their cash flow by closing a gap most owners don’t even realize exists: the disconnect between where PrintSmith Vision’s workflow ends and where payment collection begins. The lessons they’ve learned apply to any small business navigating the pressures of tight margins, labor constraints, and customers who expect seamless digital experiences.

What follows are five principles drawn from print shops that have successfully automated their payment processes. These aren’t theoretical concepts. They’re battle-tested insights from businesses that have reduced overdue invoices by 72%, cut processing time from hours to minutes, and recovered thousands in previously uncollected revenue.

Lesson 1: The Invoice Isn’t Done Until Payment Is Automatic

Most print shop owners consider the invoice the final step in a job. The work is complete, the document is sent, and now they wait. But this mindset creates a blind spot that costs real money.

The moment an invoice leaves your system without an embedded payment mechanism, you’ve introduced friction. Your customer receives the document, sets it aside, and intends to pay later. Later becomes next week. Next week becomes next month. Meanwhile, you’re financing their cash flow instead of your own.

The Fix

Every invoice should include a clickable “Pay Now” button that requires zero additional steps from your team. When payments post automatically to PrintSmith Vision without manual entry, the invoice truly closes itself. One Ohio commercial printer implemented this approach and reduced overdue invoices by 72% within 90 days.

The principle extends beyond print shops. Any service business that sends invoices and waits for payment is leaving money on the table. The technology exists to eliminate that gap entirely—the question is whether you’re using it.

Lesson 2: Reach Customers Where They Actually Are

Here’s a number that should reshape how you think about customer communication: 95% of text messages are read within 3 minutes. Compare that to email, where only 20% of messages are ever opened at all.

Your customers aren’t ignoring your invoices because they don’t want to pay. They’re buried in email, managing their own businesses, drowning in the same information overload that affects everyone. Your invoice arrived in an inbox competing with 200 other messages for attention.

Text-to-Pay changes the equation entirely. When you mark a job as “Ready for Pickup” in PrintSmith Vision, your customer receives an instant text notification with the job status and a secure payment link. Many customers pay before they even arrive to collect their order—reducing counter wait times and accelerating your cash flow simultaneously.

Best Practices for Text-to-Pay Implementation

- Integrate text notifications with existing job status workflows

- Include clear payment amounts and secure one-tap links

- Set automatic triggers when jobs reach “Ready for Pickup” status

- Ensure all payments sync back to PrintSmith Vision automatically

Lesson 3: Protection Should Be Invisible

As you accept more digital payments—through invoices, text links, and your website—your exposure to fraud grows. This creates a dilemma: add security friction that frustrates legitimate customers, or accept the risk of chargebacks that can wipe out profit from dozens of jobs.

The answer is neither. Modern fraud protection operates in milliseconds, scoring transactions using machine learning and behavioral analytics before your customer even notices. The best security is invisible to legitimate buyers while blocking fraudulent attempts automatically.

FraudSight, integrated directly into the Payably payment flow, deploys in hours with no development work required. It protects every payment path—invoice links, text-to-pay, POS terminals—without adding steps for customers or complexity for your team. Your customers experience smooth, fast payments. You get comprehensive protection running behind the scenes.

Lesson 4: Automation Compounds

The real power of payment automation isn’t any single feature—it’s how multiple tools work together to create an operation that handles cash flow while you focus on production, sales, and customer relationships.

Consider the complete workflow: A job completes in PrintSmith Vision and an invoice generates with a Pay Now button automatically attached. When you mark the job ready, Text-to-Pay sends an instant notification. The customer taps to pay, FraudSight validates the transaction in milliseconds, and PrintSmith Vision updates automatically with no manual entry required.

The Compounding Effect

A wide-format shop in Florida cut payment processing from 2 hours daily to 10 minutes weekly after implementing the full automation stack. A franchise print business recovered $19,000 in previously uncollected payments within the first month. These results come not from any single improvement but from eliminating friction at every step of the payment journey.

Every minute your team doesn’t spend on payment processing becomes available for work that actually generates revenue. The math is straightforward: 15 minutes daily on manual payment entry adds up to more than 60 hours per year per employee. That’s a significant chunk of productive capacity returned to your operation.

Lesson 5: Industry-Specific Solutions Outperform Generic Tools

The print industry has unique workflows, terminology, and operational patterns that generic payment processors don’t understand. When your software vendor has never heard of a CSR, doesn’t know what net terms mean for your cash flow, or can’t explain why quick turns require quick payments, you’re working with a tool that wasn’t built for your business.

Payably exists because print shops deserve payment technology designed specifically for how they operate. The integration with PrintSmith Vision isn’t an afterthought or a third-party workaround—it’s native functionality built by a team that has served the print and sign industry for over 30 years.

What Industry-Specific Integration Delivers

- Automatic payment posting without exports or manual syncing

- Invoice status updates that reflect your actual workflow

- Support from people who understand print shop operations

- Features designed for the specific challenges of margin-compressed businesses

- No adaptation period—the system works the way you already work

The Bottom Line

Payment delays aren’t an inconvenience—they’re a threat to businesses operating on compressed margins. Every day an invoice sits unpaid is another day you’re financing your customer’s cash flow instead of investing in your own growth.

The print shops thriving today have recognized that the gap between job completion and payment collection represents one of the most significant opportunities for operational improvement available. They’ve implemented automated payment posting, text-based collection, and invisible fraud protection—not as separate initiatives, but as an integrated system that handles cash flow while they focus on what they do best.

The technology exists. The results are proven. The only question is whether you’ll close the gap before year-end or carry the cost of manual processes into another year.

Ready to See How It Works?

A 15-minute call with our PrintSmith payments team can show you exactly how these tools integrate with your existing setup. No pressure—just a focused conversation about whether automation makes sense for your operation.

Schedule Your Demo