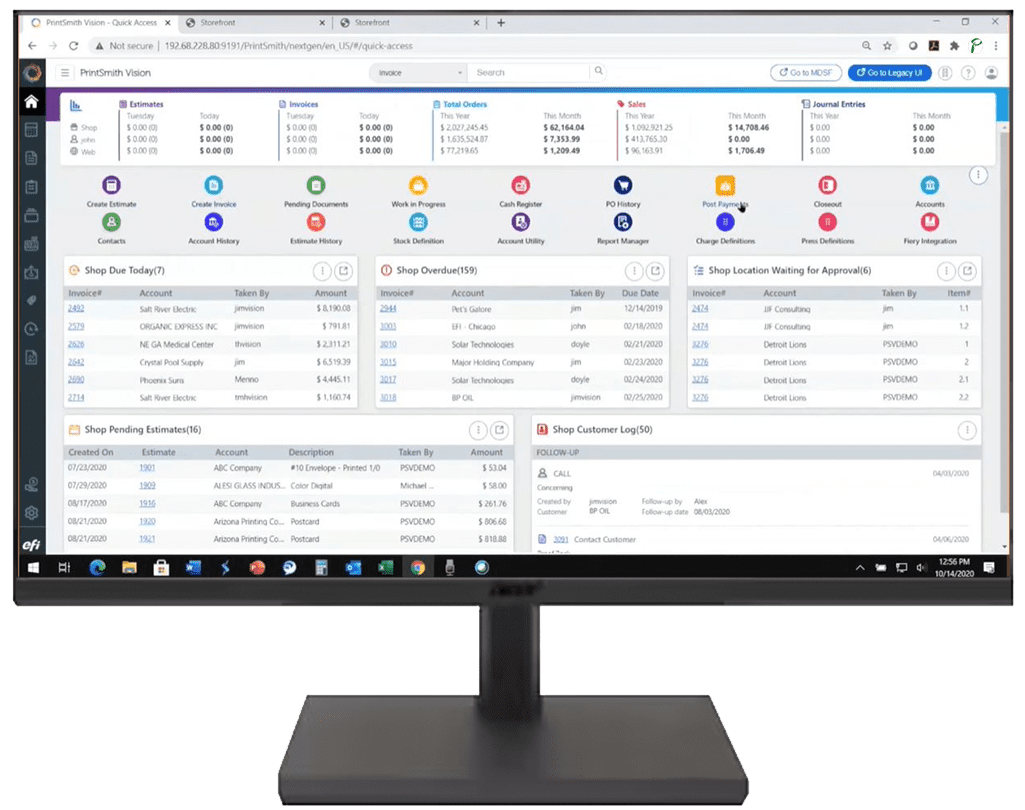

On Monday morning, Mike opens PrintSmith and clicks into Pending Documents.

54 invoices.

Some are waiting for pickup.

Some are half-paid deposits.

Some are for jobs that shipped three weeks ago.

And all of them? Still unpaid.

Mike’s stomach sinks.

He’s got payroll on Friday, a vendor bill due tomorrow, and a client who “swears the check is in the mail.” His cash flow feels like a game of Jenga—one wrong move, and the whole tower tips.

Sound familiar?

If your print shop is like most, manual AR and delayed payments are silently choking your cash flow. The good news? With the right workflow—and a little automation—you can flip the script in 30 days or less.

The Print Shop Cash Flow Problem

Manual AR isn’t just an annoyance. It’s a profit leak.

Here’s what it looks like in a typical PrintSmith workflow:

- Invoices sit in Pending Documents waiting for a pickup that never comes.

- Deposits get misapplied, leaving open balances that confuse customers and staff.

- Post Payments is a nightmare—staff spend hours chasing checks, entering reference numbers, and emailing statements.

- Cash flow swings wildly, because revenue is stuck in limbo.

In this environment, your AR is like a traffic jam: jobs are done, but the money isn’t moving.

How Automation Turns Chaos into Cash

Now, let’s fast-forward 30 days with Payably + PrintSmith Vision in the mix.

Here’s how the workflow transforms:

1. Invoices Send Themselves

When a job closes in PrintSmith, Payably + Good2Go automatically generates and sends the invoice—complete with a branded payment link.

No more “I didn’t get the invoice” excuses.

2. Customers Pay Faster with Branded Payment Pages

Instead of checks, your customers click, pay by credit card or ACH, and the payment posts directly to PrintSmith.

- Pending Documents shrink daily.

- No more double entry into Post Payments.

- Cash hits your account in days, not weeks.

3. Automated Reminders Close the Loop

Haven’t heard from a client? Payably + Good2Go sends gentle, automated reminders.

Your staff stays out of the awkward collections business—and your cash flow stabilizes automatically.

The 30-Day Cash Flow Makeover

Here’s what happens when print shops embrace payment automation:

- Week 1: Pending Documents drop as automated invoices and reminders go live.

- Week 2: Customers start using ACH and credit cards, bypassing slow paper checks.

- Week 3: Deposits and payments post automatically into PrintSmith Vision.

- Week 4: AR cycles shorten, and cash flow becomes predictable and stress-free.

Mike’s shop?

- Payroll is on time.

- Vendor bills are paid early.

- He finally gets to stop refreshing his bank app every 15 minutes.

Ready to Go from Chaos to Cash?

Manual AR is a silent profit killer. But in 30 days, your shop can go from chasing payments to predictable, automated cash flow.

Here’s how to start:

📄 Download the Print Shop Payment Automation Checklist

🎥 Book a Live Demo of Payably + PrintSmith Vision

Let your AR run on autopilot—and focus on growing your print business, not chasing payments.