Running a small business means juggling countless responsibilities every day. Among them, there’s one critical priority that often gets overlooked until it’s too late: fraud protection.

Many small business owners assume fraud only happens to large corporations. That assumption is precisely what makes them vulnerable. Fraudsters actively target businesses that aren’t prepared, and the consequences can be devastating.

The Growing Threat of Fraud

The numbers tell a sobering story. According to Juniper Research, merchant losses from online payment fraud are projected to exceed $362 billion globally between now and 2028. This isn’t just a problem for big-name brands—small businesses are increasingly in the crosshairs.

How Did We Get Here?

Fraud has existed wherever payments happen, but recent years have seen an alarming escalation. The COVID-19 pandemic forced many brick-and-mortar businesses to shift sales online rapidly, often without adequate preparation for the unique fraud risks of eCommerce. This created opportunities for criminals to advance their attacks with unprecedented success.

Today, assisted by artificial intelligence, fraud has become more sophisticated than ever. Fraudsters are unrelenting, and their tactics grow more aggressive and complex by the day, making attacks harder to identify and avoid.

Why Small Businesses Are Prime Targets

When criminals gain access to personal information, they can monetize that data by selling it on the dark web. Purchasers of stolen identities then make fraudulent purchases or set up fraudulent accounts. Small businesses represent both a pathway to valuable customer data and a source from which fraudsters can directly steal goods and services.

The impact on small businesses is particularly severe. A 2022 report from the Association of Certified Fraud Examiners reviewed thousands of fraud cases across 133 countries and found that small businesses experienced a median loss of $115,000 per case—comparable to the $138,000 median loss for large organizations. However, as the report concluded, the impact of such a loss “is far more significant at a smaller organization.”

For a small business, a six-figure fraud loss can threaten stability, damage reputation, and even force closure. Without adequate protection, the financial and reputational consequences can be catastrophic.

Today’s Most Common Fraud Tactics

Understanding current fraud trends is essential, but challenging. As one fraud expert notes, “Even if you master the fraud trends of today, six months down the road, it’s an entirely new conversation.” Fraud evolves constantly, requiring ongoing vigilance.

Email Phishing and Text Smishing

Phishing emails and smishing text messages lure victims to open corrupt links or files, giving fraudsters access to inject malware that can paralyze systems. With AI assistance, attackers now create highly personalized content that’s increasingly difficult to distinguish from legitimate communications.

Account Takeover

Often resulting from successful phishing or smishing attacks, account takeover occurs when criminals access and control personal accounts. From there, they can transfer money, leverage stored credit card data, and change account information at will.

Card Testing

This tactic is particularly harmful to small businesses. Fraudsters run scripts on business checkout pages to process thousands of small-amount transactions, testing stolen credit card numbers to identify which cards are active. This high-velocity testing can rack up thousands of dollars in processing fees for the victim. Even worse, when card issuers notice the suspicious traffic, they may block all transactions—including legitimate ones—effectively shutting down the business.

The Cost of Doing Business—But Not the Cost of Your Business

Running your business without fraud protection strategies is like leaving your shop’s front door unlocked every night. There’s a chance nothing will happen, but it’s far more likely that something will. When an attack occurs, you’ll find yourself in a difficult position—one that could have been prevented.

As a business owner, you’re responsible for keeping your customers safe while maintaining business growth. Without fraud protection, you put both at risk.

How to Protect Your Business from Fraud

The good news: there are practical steps you can take today to help prevent fraud attacks.

Implement Basic Security Measures

Update Passwords Regularly

Maintain strong, unique passwords for all business systems and update them frequently. Consider using a password manager to generate and store complex passwords securely.

Educate Your Team

Your employees are your first line of defense. Train them on current fraud trends and how to identify suspicious activity. Regular training sessions keep fraud awareness top of mind.

Limit System Access

Restrict access to sensitive systems and data to only those who genuinely need it. The fewer access points, the smaller your vulnerability surface.

Maintain PCI Compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance isn’t optional—it’s essential. These standards exist to protect cardholder data and reduce fraud risk. Ensure your business maintains compliance at all times.

Deploy Technology Solutions

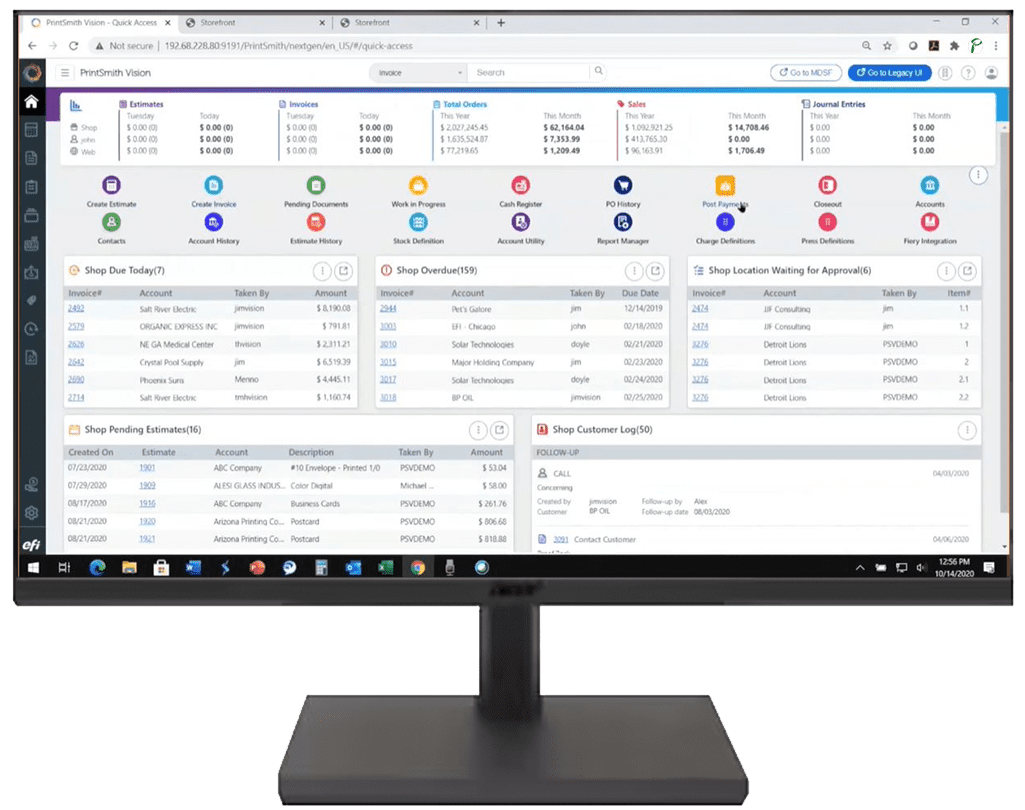

One of the most powerful ways to fight fraud is with technology that stays ahead of evolving threats. Modern fraud prevention solutions use machine learning to observe trends, detect anomalies, and stop fraudulent transactions in real time.

The best solutions work invisibly in the background, analyzing every transaction against billions of data points to identify suspicious patterns. They can detect and decline fraudulent transactions before they’re authorized, preventing attacks without disrupting legitimate business.

Look for fraud protection that:

- Uses real-time decisioning to stop threats instantly

- Leverages machine learning that improves continuously

- Stops fraud while allowing good transactions to proceed

- Requires minimal setup and maintenance from you

- Provides expert support when you need it

Choose the Right Payment Partner

Your payment processor plays a crucial role in fraud prevention. When evaluating payment solutions, consider:

Integrated Protection

Look for payment systems with built-in fraud protection rather than requiring separate third-party solutions. Integration means better data flow and more effective fraud detection.

Scalable Solutions

Choose fraud protection that grows with your business, providing enterprise-level security at a price point appropriate for your size.

Expert Support

Fraud is complex and constantly evolving. Partner with providers who employ certified fraud professionals and payments experts who can support your business when threats emerge.

What If You’re Already a Victim?

Discovering your business has been targeted can be alarming, especially if you don’t have protection measures in place. While prevention is always the best approach, recovery options do exist if you’ve been attacked.

Immediate Actions

If you suspect or confirm fraud:

Document Everything

Record all suspicious transactions, communications, and activities. This documentation will be essential for reporting and recovery.Contact Your Payment Processor Immediately

Report the fraud to your payment processor right away. They can help halt suspicious transactions and implement protective measures.Notify Affected Customers

If customer data has been compromised, transparency is critical. Notify affected customers promptly and advise them on protective steps they should take.Report to Authorities

File reports with appropriate law enforcement agencies and regulatory bodies. This creates an official record and may help with recovery efforts.Implement Protection Immediately

Don’t wait to activate fraud protection solutions. Implement them immediately to prevent further attacks.

Fighting Back

With the right partner and tools, you can take back control of your business. Aggressive protective strategies can stop attackers and deter future fraudulent attempts. Modern fraud prevention solutions can be activated quickly—some with zero integration required—to start protecting your business immediately.

Fraud Is Now Part of Business—But It Doesn’t Have to Break Your Business

The reality is clear: fraud is now a cost of doing business. Every business that accepts payments faces fraud risk. However, that doesn’t mean fraud has to threaten your business’s survival.

By understanding the threats, implementing basic security practices, and deploying professional fraud protection solutions, you can keep your business growing without interruption. Your customers depend on you to keep their information safe. Your business depends on maintaining their trust.

Protection against fraud isn’t just about stopping bad transactions—it’s about ensuring good business can continue uninterrupted. It’s about maintaining the seamless payment experience your customers expect while operating with confidence that your business is secure.

Take Action Today

Don’t wait until you become a victim to prioritize fraud protection. The small investment in prevention today can save you from catastrophic losses tomorrow. Evaluate your current fraud vulnerabilities, implement basic security measures, and consider deploying professional fraud protection technology.

Your business has potential to grow and thrive. Don’t let fraud threaten that potential. Take control of your security today, and focus on what you do best—running your business.

Ready to protect your business while streamlining your payments? Learn more about how Payably can help your business grow securely.