Walk through any printing industry trade show, and you’ll find no shortage of vendors promising to transform your business. CRM platforms that manage every customer touchpoint. Marketing automation tools that write your emails. Dashboard solutions that track metrics you didn’t know existed. Each one comes with its own monthly subscription, learning curve, and implementation timeline.

But here’s a question worth sitting with: Is adding another layer of software really the answer to your cash flow challenges?

For many small and medium-sized print shops, the honest answer is no. And recognizing that isn’t a failure to modernize—it’s smart business.

The Software You Already Own

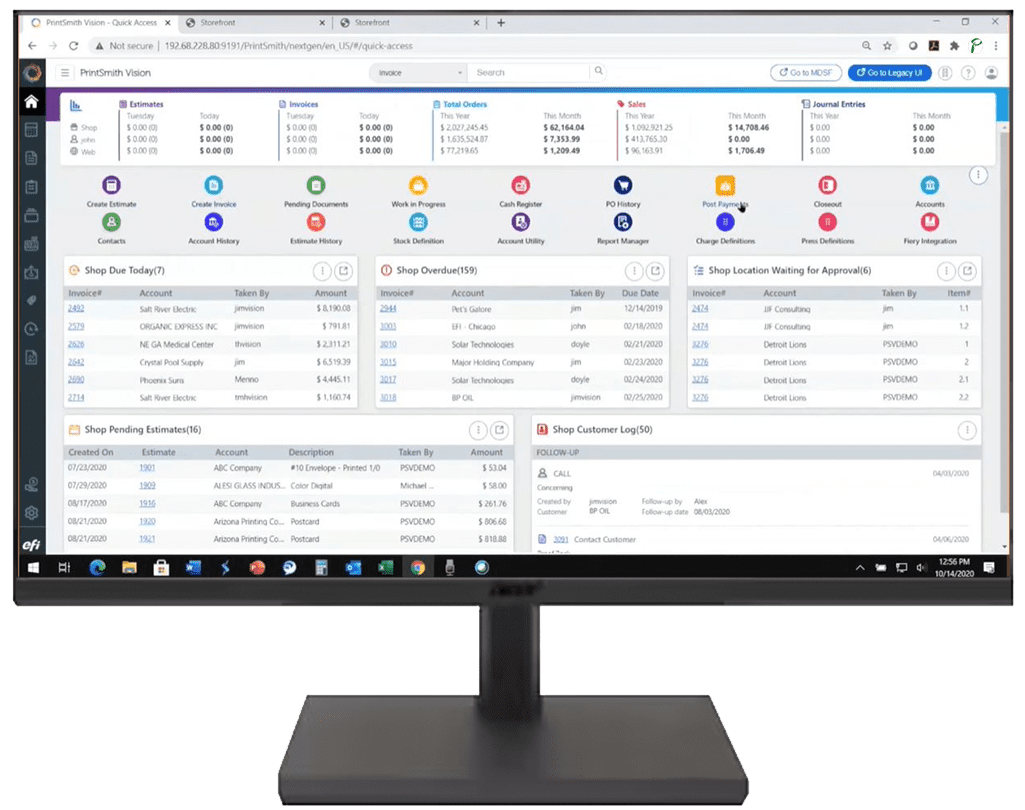

Most print shops already have capable management software in place. PrintSmith Vision, for example, handles job estimating, production tracking, invoicing, and customer management. It’s designed specifically for print operations, not adapted from generic business tools.

Yet industry surveys consistently show that businesses use only a fraction of their software’s capabilities. Some estimates suggest that figure hovers around 10% for complex platforms. That’s a significant gap—and it represents real opportunity.

Before adding a CRM that promises to revolutionize your customer relationships, ask yourself: Am I using the customer management tools already built into my MIS? Before subscribing to an automation platform, consider: Have I explored the workflow features I’m already paying for?

The most expensive software in your shop isn’t necessarily the one with the highest subscription fee. It’s the one gathering dust while you pay for something else to do the same job.

The CRM Mirage for A/R Problems

Here’s where things get particularly expensive for print shop owners: using CRM solutions to chase down unpaid invoices.

On the surface, it sounds logical. A CRM can automate email reminders. It can schedule follow-up tasks. It can track which customers haven’t paid and flag them for attention. Some platforms even promise to reduce accounts receivable through systematic communication campaigns.

But there’s a fundamental problem with this approach. A CRM is designed to manage relationships, not collect money.

When you use a CRM to send billing reminders, you’re adding complexity without addressing the root cause. You’re paying for a sophisticated customer tracking system to do something much simpler: remind people they owe you money. Meanwhile, you’re still waiting the same 30, 45, or 60 days for payment. The emails go out faster, but the cash doesn’t come in any quicker.

The math rarely works in your favor. CRM platforms carry monthly fees ranging from $50 per user for basic tiers to several hundred dollars for enterprise features. Add implementation costs, training time, and the ongoing maintenance of keeping data clean and campaigns running. For a shop doing $500,000 to $700,000 in annual revenue—which describes many SMB print operations—that investment represents a meaningful percentage of already-thin margins.

Automation Doesn’t Accelerate Payment

This is the uncomfortable truth that software vendors rarely mention. Sending more emails, more often, through a more expensive system doesn’t change when customers decide to pay. Your automation might ensure no invoice falls through the cracks, but it doesn’t give customers a faster or easier way to settle their accounts.

What actually accelerates payment? Making it effortless for customers to pay at the moment they’re ready. Integrating payment directly into the invoicing process so there’s no friction between receiving a bill and settling it. Offering payment options that work for your customers’ businesses, not just your own preferences.

These aren’t CRM functions. They’re payment processing functions. And trying to solve them with relationship management software is like using a hammer when you need a screwdriver. You might eventually get the job done, but you’ll create unnecessary damage along the way.

Ready to See What Integrated Payments Can Do?

Payably connects directly with PrintSmith Vision, turning invoices into paid deposits without the complexity of additional software.

The Hidden Costs of Complexity

Every piece of software you add to your operation carries costs beyond the subscription price. There’s the time spent learning the system—time that could be spent producing jobs or talking with customers. There’s the mental overhead of switching between platforms throughout the day. There’s the risk of data inconsistencies when information lives in multiple places.

For print shops especially, this complexity compounds quickly. Your MIS handles production. Your accounting software handles books. Your CRM handles customer outreach. Your payment processor handles transactions. Your email platform handles communications. Each system requires attention, updates, and troubleshooting.

At some point, managing your software stack becomes a job unto itself. And that’s a job that doesn’t produce a single printed piece or bring in a single dollar of revenue.

User Adoption: The Factor Nobody Talks About

Software only works when people use it. This seems obvious, but it’s routinely ignored when businesses evaluate new tools.

That sophisticated CRM with automated sequences and customer scoring? It requires someone to input data consistently. It needs someone to monitor campaigns and adjust messaging. It demands ongoing attention to deliver the promised benefits.

In a print shop where the owner is also the estimator, the customer service rep, and sometimes the press operator, who exactly is going to maintain that CRM? The answer, in many cases, is nobody. The software gets set up with good intentions, runs for a few months on autopilot, and gradually becomes another unused tool eating up budget.

Before investing in new software, honestly assess your team’s capacity to adopt it. Better yet, focus on fully utilizing what you already have. The return on that effort is often higher than any new subscription could provide.

What Actually Solves A/R Challenges

If CRM automation isn’t the answer, what is?

Start with making payment as simple as possible. When customers receive an invoice that includes a direct payment link—one that connects seamlessly to your existing systems—friction disappears. They click, pay, and both parties move on with their day.

Consider the payment methods you accept. Credit cards and ACH each serve different customer needs. Offering both, with transparent pricing, removes barriers that might delay payment.

Look at how payments integrate with your existing workflow. When transactions automatically sync with your invoicing system, you eliminate manual data entry, reduce errors, and maintain a single source of truth for your financial picture.

These improvements don’t require adding another platform to your technology stack. They require smarter use of payment processing that’s designed to work with tools you already own.

Incremental Progress Over Dramatic Overhaul

The print industry has weathered dramatic change over the past two decades. Digital disruption, consolidation, evolving customer expectations—shop owners have adapted through all of it. That adaptation happened not through sweeping transformations, but through steady, practical improvements.

Apply that same wisdom to your software decisions. Instead of chasing the next platform that promises to revolutionize your operations, focus on extracting more value from your current tools. Train your team on features they’ve never used. Clean up data that’s gone stale. Streamline workflows that have grown complicated over time.

And when you do add new capabilities, choose solutions that integrate with what you have rather than replacing it. The goal is simplification, not accumulation.

Real transformation in a print shop doesn’t happen when you buy new software. It happens when your team uses existing tools more effectively and when payments flow without friction.

The Bottom Line

Your print shop doesn’t need an expensive CRM to solve accounts receivable challenges. It doesn’t need marketing automation to send invoices. It doesn’t need another subscription eating into margins that are already thin enough.

What it needs is payment processing that works with your production software, not alongside it. Integration that means when a job ships, the invoice goes out, and the payment comes back—without manual steps, without chasing, without delay.

Simplicity isn’t a limitation. For print shops operating on 1-3% net margins, simplicity is a competitive advantage. It’s the difference between spending your day managing software and spending your day running your business.

Sometimes the smartest technology decision isn’t adding something new. It’s recognizing that what you already have, used well, might be exactly enough.

See How Print Shops Are Getting Paid 20% Faster

No new platforms to learn. No complex implementations. Just seamless payment processing that works with PrintSmith Vision.