Payment Fraud Protection for Print Shops: What Every SMB Owner Needs to Know

Security & Compliance • Best Practices • Business Protection

“Why would anyone target my little print shop?” It’s a question many small business owners ask—and a dangerous assumption that costs thousands of businesses real money every year.

The uncomfortable truth is that small and mid-sized print shops aren’t overlooked by fraudsters—they’re actively targeted. Not because criminals manually select victims, but because automated fraud tools probe thousands of payment systems simultaneously, looking for the path of least resistance. And small businesses, with limited IT resources and often basic security measures, frequently represent exactly that path.

Understanding why your print shop needs fraud protection—and how modern payment security works—isn’t just about preventing worst-case scenarios. It’s about building a foundation that lets you accept payments confidently, serve customers efficiently, and protect the margins you work hard to earn.

The Reality of Fraud Risk for Small Businesses

The data tells a story that contradicts many business owners’ assumptions. According to industry research, 43% of cyberattacks target small businesses. This isn’t random—it’s strategic. Fraudsters know that smaller operations often lack dedicated security personnel, sophisticated monitoring systems, and the resources to pursue fraud aggressively after the fact.

For print shops specifically, the vulnerability comes from multiple directions. Online payment portals for customer deposits and final payments. Stored card information for repeat customers. Invoice payment links sent via email. Each touchpoint represents a potential entry for fraud—and each requires protection.

What makes the situation particularly challenging for print businesses is the nature of the work itself. Many jobs involve custom production that begins before payment clears. Rush orders may require accepting payment and starting work simultaneously. Large format work often means significant material investments before revenue is secured. These operational realities create windows that sophisticated fraudsters understand and exploit.

Understanding How Modern Payment Fraud Works

Payment fraud has evolved far beyond the stereotype of someone manually typing stolen card numbers. Today’s fraud landscape involves automated systems that can test thousands of card numbers against a single payment page in minutes. Understanding these methods helps clarify why traditional “vigilance” alone isn’t sufficient protection.

Card Testing Attacks

Fraudsters use automated scripts to validate stolen card data against live payment systems. Your payment page might receive dozens of small transaction attempts in rapid succession—each one testing whether a stolen card number is still active. Without velocity monitoring and pattern detection, these tests succeed, validating the card for larger fraud elsewhere.

First-Party Fraud

Sometimes fraud comes from actual customers who receive legitimate goods and then dispute the charge with their card issuer. They claim the transaction was unauthorized, triggering a chargeback that pulls the money back—even though they have your product in hand. Without proper documentation and verification, merchants have limited recourse.

Account Takeover

When customer account credentials are compromised elsewhere and reused on your platform, fraudsters can access stored payment methods, change shipping addresses, and place fraudulent orders under a legitimate customer’s identity. These attacks are particularly difficult to detect because they appear to be returning customers.

Why Manual Vigilance Isn’t Enough

Even the most attentive business owner can’t manually review every transaction for fraud indicators. Automated attacks happen in milliseconds. Pattern recognition across thousands of data points exceeds human capability. And by the time suspicious activity becomes obvious, the damage is often already done. Effective protection requires systems that work at machine speed, examining every transaction before it completes.

The True Cost of Payment Fraud

When fraud hits a small print shop, the financial damage extends far beyond the transaction amount itself. Understanding the full cost helps clarify why prevention is always more economical than recovery.

Consider a fraudulent order for $2,500 of large format printing. The direct losses include the $2,500 transaction amount that gets clawed back in the chargeback process, the materials and production time already invested in the job, and chargeback fees that typically range from $25 to $100 per incident. But the indirect costs often exceed the direct ones.

Your payment processor tracks chargeback ratios. Too many incidents—even if you’re the victim—can result in higher processing rates, reserve requirements, or account termination. The administrative time spent documenting disputes, communicating with processors, and attempting recovery has real value. And if fraud becomes a pattern, the operational disruption compounds with each incident.

The Margin Math That Matters

For a print shop operating on 2-3% net margins—common in this industry—a single $2,500 fraud loss requires $80,000 to $125,000 in additional revenue just to recover the lost profit. One bad transaction can erase months of careful work building your business.

What Effective Payment Protection Looks Like

Modern fraud prevention operates on multiple layers simultaneously. Each layer catches different types of suspicious activity, and together they create a security posture that stops the vast majority of fraud attempts before they become your problem.

The Security Stack Your Payments Need

Confirms the card is valid and that the billing information provided matches what the card issuer has on file. This basic check stops the most obvious fraud attempts.

Tracks transaction patterns in real time, flagging unusual activity like multiple transactions from the same card in rapid succession, or numerous failed attempts followed by a success.

Compares transaction characteristics against known fraud patterns and behaviors, identifying suspicious combinations that individually might not raise flags.

Adds an additional verification step for higher-risk transactions, requiring cardholders to authenticate through their issuing bank before the payment completes.

The key is that these protections should operate invisibly for legitimate transactions. Your customers shouldn’t experience friction or delays. The security works in the background, examining each transaction in milliseconds and only intervening when genuine risk is detected.

Best Practices for Print Shop Payment Security

Beyond the automated protections built into modern payment systems, print shop owners can take specific steps to reduce fraud risk in their daily operations.

Verify Large or Unusual Orders

When a new customer places a significantly larger order than typical, or requests rush delivery to a new address, take time to verify. A quick phone call to confirm details isn’t just good customer service—it’s fraud prevention. Legitimate customers appreciate the attention; fraudsters disappear.

Be Cautious with Rush International Orders

Orders requesting expedited international shipping, particularly from new customers, warrant extra scrutiny. This pattern frequently appears in fraud attempts because it maximizes the window between order and delivery, complicating recovery.

Watch for Shipping Address Discrepancies

When billing and shipping addresses differ significantly—especially if the shipping address is to a freight forwarder or unfamiliar location—additional verification is appropriate. This is a common fraud pattern across all e-commerce, not just print.

Document Everything

If a chargeback does occur, your ability to dispute it depends entirely on documentation. Keep records of customer communications, delivery confirmations, proof of authorization, and anything else that demonstrates the transaction was legitimate. This documentation is your defense.

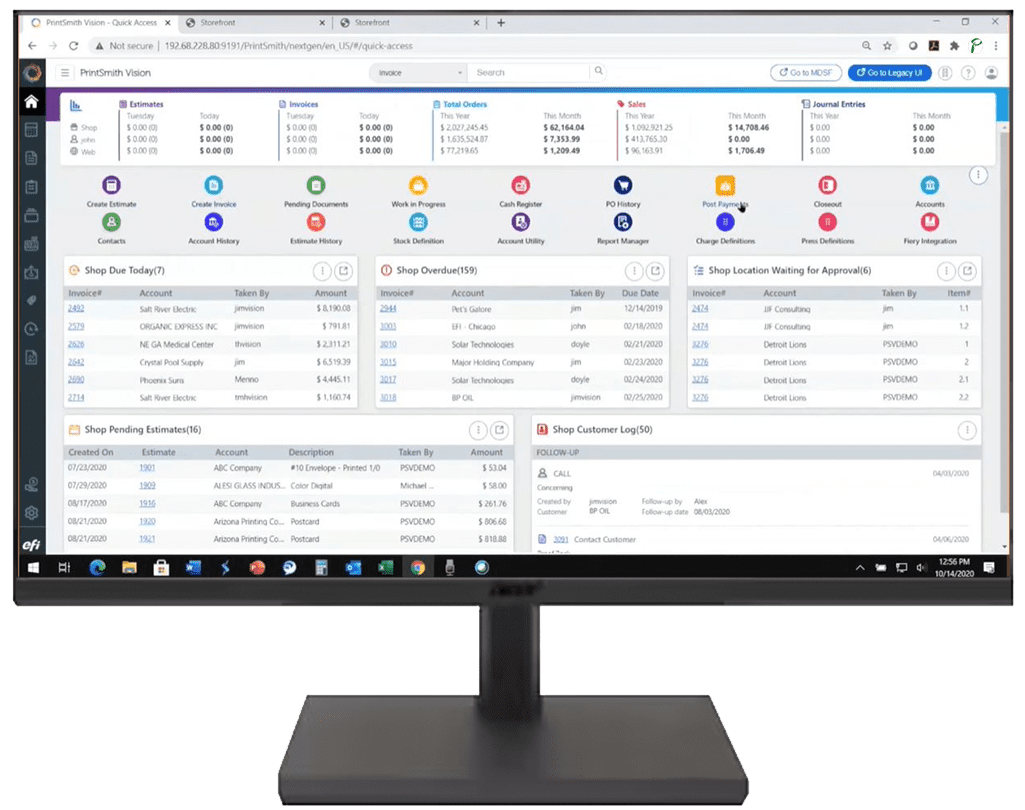

Use Payment Systems Designed for Your Business

Generic payment processors may lack the fraud detection tuned for print industry patterns. Solutions built specifically for print shops understand typical transaction sizes, customer behaviors, and risk factors unique to this business—enabling more accurate fraud detection with fewer false positives that frustrate legitimate customers.

Why “Set and Forget” Security Matters

For most print shop owners, becoming a payment security expert isn’t realistic or desirable. You have production to manage, customers to serve, equipment to maintain, and a business to grow. Security that demands constant attention diverts resources from these core priorities.

The most effective protection for small businesses is security that’s embedded directly in the payment process—not bolted on as an afterthought. When fraud prevention operates as a fundamental part of how transactions process, it doesn’t require separate logins, additional dashboards, or expertise you don’t have time to develop.

This is exactly why integrated payment solutions matter. When your payment processing, fraud detection, and management information system work together seamlessly, protection happens automatically. Every transaction—whether it arrives at 10 AM or 3 AM, whether you’re in the shop or on vacation—receives the same rigorous security screening.

Protection That Scales With Your Business

Whether you process ten transactions a week or ten thousand, effective fraud protection should scale automatically. You shouldn’t need to upgrade, add modules, or pay premium fees for security features. Enterprise-grade protection for every transaction, regardless of business size—that’s the standard your payment partner should meet.

Taking Action: What to Do Now

Protecting your print shop from payment fraud doesn’t require a complete operational overhaul. Start by understanding what protection you currently have—and what gaps might exist.

Ask your payment processor specifically about fraud detection capabilities. Do they offer real-time transaction monitoring? Velocity checks? 3D Secure support? Address verification? If you can’t get clear answers, that’s a signal worth noting.

Review your chargeback history. Even a few incidents annually suggest your current protection may have gaps. Look for patterns—similar transaction types, customer profiles, or timing—that might indicate systematic vulnerability.

Consider whether your current payment solution was designed with businesses like yours in mind. Generic processors serving every industry may lack the specific detection patterns that matter for print operations. Solutions built for the print industry understand your unique needs.

Small business doesn’t mean small protection. Your margins depend on every transaction being legitimate—and your operations depend on fraud prevention that works without demanding your attention.

See How Payably Protects Your Payments

FraudSight protection comes standard with every Payably account—enterprise-grade security built specifically for print shops, with no premium fees or complex setup.

Learn About FraudSight