Embedded Payments for Web-to-Print: What SMB Owners Need to Know

Payment Processing • Web-to-Print • Business Growth

Pinnacle Award 2025 Winner

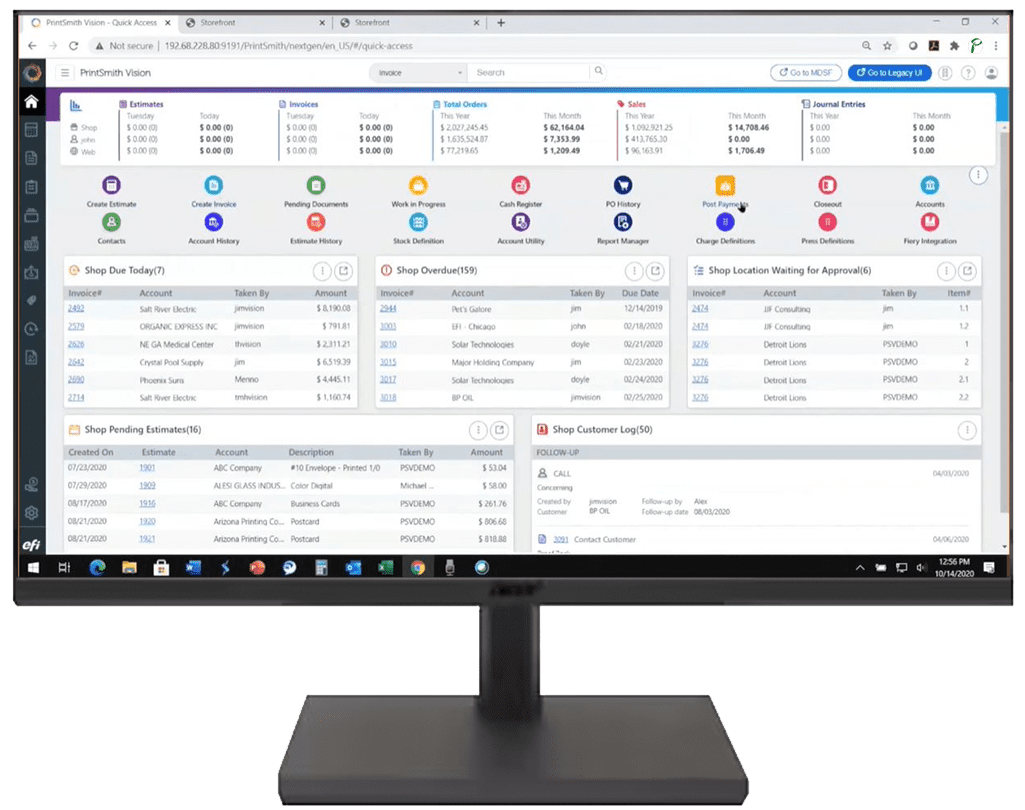

The web-to-print industry has transformed how print businesses operate. Customers expect seamless online ordering, instant quotes, and frictionless checkout experiences. Yet many print shop owners discover a frustrating gap in their otherwise modern workflow: payment processing that feels like an afterthought.

When your web-to-print platform handles everything from design proofing to job management with precision, why should collecting payment require customers to leave your branded environment? Why should reconciling transactions demand hours of manual work each week?

The answer is straightforward: it shouldn’t. Embedded payment processing changes how print businesses handle the financial side of every transaction, creating efficiencies that directly impact profitability. The integration between OnPrintShop and Payably Finance offers a case study in what this looks like in practice—and the lessons apply whether you’re running a small commercial printer or scaling toward enterprise-level production.

The Disconnect in Most Web-to-Print Workflows

Consider a typical scenario. A customer visits your online storefront, uploads their artwork, receives an instant quote, approves the proof, and proceeds to checkout. Everything flows smoothly until that final step. Then they’re redirected to a third-party payment page with different branding. Or they receive an invoice via email and must navigate to a separate portal to pay. Or worse, they call your office with a credit card number that someone manually keys into a terminal.

Each of these scenarios creates friction. More importantly, each represents a point where your carefully constructed customer experience breaks down—and where errors can enter your financial workflow.

Print shops running on thin margins (often 1-3% net profit) cannot afford the inefficiencies that fragmented payment systems introduce. When payment collection stretches beyond 30 days, cash flow suffers. When staff spend 15-20 hours weekly on manual reconciliation, labor costs climb. When customers encounter checkout friction, conversion rates drop.

The core principle: Your payment processing should be invisible to customers and effortless for your team. When payments embed directly into your existing workflow, every transaction flows from order to deposit without manual intervention or disconnected systems.

The Checkout Experience Gap: Why Payment UI/UX Matters

Print shop owners invest considerable time evaluating web-to-print platforms. They compare design tools, proofing capabilities, job management features, and integration options. Yet one critical element often receives little attention during the selection process: the payment experience their customers will encounter at checkout.

This oversight carries real consequences. Your print buyers don’t evaluate their checkout experience against other print shops—they compare it against every online purchase they’ve made. The same customer who orders business cards from your storefront also buys products from major retailers with one-click purchasing, saved payment methods, and seamless guest checkout options. When your web-to-print checkout feels clunky by comparison, that perception colors their entire experience with your business.

The Expectation Reality

Today’s buyers expect the same purchasing convenience from a print shop that they receive from any eCommerce platform. Saved payment methods. Guest checkout options. Mobile-optimized forms. Instant confirmation. These aren’t premium features—they’re baseline expectations shaped by years of refined eCommerce experiences across every industry.

The challenge is that most technology serving the print industry hasn’t kept pace with mainstream eCommerce standards. While platforms in retail, hospitality, and professional services have embraced sophisticated payment experiences, many web-to-print solutions still treat checkout as an afterthought—a necessary step rather than a conversion opportunity.

This gap represents both a problem and an opportunity for SMB print shops. The problem: inferior checkout experiences cost you sales. Customers abandon carts. First-time buyers don’t return. The opportunity: print shops that deliver modern payment experiences differentiate themselves in a market where mediocre checkout is the norm.

What Modern Print Buyers Actually Expect

Understanding buyer expectations requires recognizing that your customers live in an eCommerce-saturated world. Consider what they experience elsewhere:

❌ Typical Web-to-Print Checkout

- Redirect to third-party payment page

- Re-enter billing information every order

- Limited payment options

- Clunky mobile experience

- Manual invoice and payment matching

- Unclear confirmation process

✓ Modern eCommerce Standard

- Seamless branded checkout

- Saved payment methods for returning customers

- Cards, ACH, Apple Pay, Google Pay

- Mobile-first responsive design

- Automatic reconciliation

- Instant confirmation and receipts

First-time buyers need a frictionless path from cart to confirmation. Returning customers—the foundation of any healthy print business—expect their payment preferences remembered. B2B accounts require invoicing options that integrate with their procurement processes. Each buyer type demands a checkout experience that respects their time and matches their expectations.

The web-to-print platform you choose should deliver this same value. Your storefront competes not just with other print shops, but with every online purchasing experience your customers have encountered. When technology serving the print industry falls short of these standards, print shops bear the cost in lost conversions and diminished customer loyalty.

Bridging the Gap: OnPrintShop’s Approach to Checkout Excellence

OnPrintShop has recognized that web-to-print platforms must deliver the same purchasing sophistication that buyers experience across other eCommerce verticals. Their platform approaches checkout not as an isolated transaction step, but as an integral part of the customer journey that directly impacts conversion rates and repeat business.

The platform’s intuitive UI/UX extends through the entire buyer experience—from initial product browsing through payment completion. Design tools that simplify artwork creation flow naturally into proofing workflows that build buyer confidence, culminating in a checkout experience that feels familiar to anyone who has purchased online.

This attention to the complete buyer journey helps drive measurable results for SMB print shops. When customers encounter a professional, streamlined checkout that matches their expectations, they complete purchases. When returning customers find their preferences remembered and their checkout simplified, they come back.

The results speak directly to the bottom line. Print businesses implementing integrated payment solutions report measurable improvements in revenue, processing efficiency, and turnaround times that compound over months and years of operation.

— Gene Hamzhie, Fire Sprint Printing (48% revenue growth)

What Embedded Payments Actually Means

Embedded payment processing integrates financial transactions directly into your operational software. Rather than treating payments as a separate function handled by a separate system, embedded solutions make payment collection a natural extension of your existing workflow.

For web-to-print operations, this translates to several practical capabilities:

Branded checkout experiences. Customers complete payment within your storefront environment. Your logo, your colors, your domain—no redirects to generic payment pages that undermine the professional image you’ve built.

Automatic reconciliation. Transaction data flows directly into your accounting systems. When a customer pays online, that payment appears in your records without someone manually matching invoices to deposits.

Real-time visibility. Every transaction becomes traceable from the moment a customer clicks “pay” through settlement in your bank account. No more wondering where a payment stands in the processing pipeline.

Multiple payment methods. Credit cards, debit cards, ACH bank transfers, digital wallets like Apple Pay and Google Pay—all accepted through a single integration rather than cobbled-together solutions from multiple providers.

When Payably Finance integrates with OnPrintShop, these capabilities combine with a platform already designed for checkout excellence. The result is a complete eCommerce experience that matches what buyers expect from leading online retailers—delivered specifically for the print industry’s unique requirements.

Security That Matches Your Workflow Speed

Speed without security creates liability. Print shop owners handling customer payment data carry responsibilities that extend beyond efficient operations—they must protect sensitive financial information against increasingly sophisticated threats.

Effective embedded payment solutions address this through multiple layers of protection that operate invisibly within your workflow:

PCI DSS Compliance

Industry-standard security protocols protecting every transaction

Tokenization

Sensitive card data replaced with secure tokens—never stored on your systems

Direct-to-Bank Routing

Full traceability from payment initiation through deposit

Real-Time Monitoring

Automated fraud detection on every transaction

The OnPrintShop platform itself maintains ISO 27001:2022 and ISO 9001:2015 certifications—international standards for information security and quality management. When payment processing matches these security standards, print shop owners gain protection without sacrificing the workflow automation that makes web-to-print profitable.

Ready to Streamline Your Payment Workflow?

See how embedded payments integrate with your web-to-print operations.

Learn MoreBest Practices for SMB Print Businesses

Implementing embedded payments effectively requires more than selecting a provider. The print businesses seeing the strongest results follow consistent patterns:

Implementation Essentials

- Evaluate checkout experience as critically as design tools. Test the payment flow yourself. Better yet, ask customers for feedback. A sophisticated design editor means nothing if checkout drives buyers away.

- Map your current workflow first. Document every step from job completion to funds in your bank account. Identify where delays occur, where errors enter, and where manual effort adds time without adding value.

- Prioritize integration depth over feature lists. A payment solution that connects seamlessly with your existing systems delivers more value than one offering features you won’t use.

- Maintain consistent branding throughout checkout. Every redirect or visual inconsistency reduces customer confidence. Your payment experience should feel like a natural extension of your storefront.

- Consider both first-time and returning customer experiences. Guest checkout options matter for new buyers. Saved payment methods matter for repeat customers. Address both.

- Monitor conversion rates at checkout. Track how many customers start the payment process versus how many complete it. Friction in your checkout shows up here first.

When your workflow automation extends through payment collection, the compound effects become visible quickly. Teams report spending less time on administrative tasks, customers experience smoother transactions, and cash flow becomes more predictable.

The platform made a noticeable difference in how quickly we complete orders. When checkout matches the rest of the experience, customers move through faster and come back more often.

— Mike Shabluk, Erie Custom Signs (2-week faster turnaround)

The Broader Integration Picture

Payment processing represents one piece of a larger operational puzzle. The most successful web-to-print operations connect multiple systems into cohesive workflows: accounting software like QuickBooks and Zoho, CRM platforms like HubSpot, shipping solutions, inventory management, and production scheduling tools.

When evaluating any platform or integration, consider how it connects to your broader ecosystem. A payment solution that integrates deeply with your web-to-print platform but disconnects from your accounting software simply moves the manual reconciliation problem to a different location.

The goal isn’t automation for its own sake. The goal is building workflows where data flows naturally between systems, reducing the manual touchpoints where errors enter and time disappears. Payment processing, done correctly, becomes invisible—another automated step in a process that runs efficiently from initial customer contact through final delivery.

Moving Forward

The print industry continues evolving. Customer expectations rise. Technology capabilities expand. Margins remain competitive. The businesses that thrive are those that continuously improve operational efficiency without sacrificing quality or customer experience.

Payment UI/UX represents an area where many print shops still have room to improve. The checkout experience your customers encounter shapes their perception of your entire operation. When that experience falls short of what they’ve come to expect from modern eCommerce, it costs you sales and repeat business.

Platforms like OnPrintShop are working to close this gap, bringing the same checkout sophistication that drives conversions in other industries to the print sector. Combined with embedded payment processing through Payably Finance, SMB print shops can now deliver experiences that match their customers’ expectations—without the complexity of building custom solutions.

Whether you’re operating a focused commercial print shop or scaling toward enterprise-level production across multiple locations, the principles remain consistent. Don’t overlook the payment experience your customers encounter. Integrate payments into your workflow. Maintain visibility over every transaction. Protect customer data with appropriate security. Partner with providers who understand both the print industry’s unique demands and the eCommerce standards your customers expect.

The technology exists to make this straightforward. The question is simply whether you’re ready to implement it.

See Embedded Payments in Action

Discover how Payably Finance integrates with OnPrintShop to deliver eCommerce-grade checkout experiences for web-to-print businesses.

Explore the Integration Schedule a Demo