When your print shop finishes a job, there’s only one thing standing between you and cash in the bank: how your customer pays you.

Are you making it easy—or creating friction?

In 2025, customers expect flexible payment options. And for print shops, the choice between ACH bank transfers and credit cards isn’t about picking one or the other. It’s about understanding how each impacts your cash flow, fees, and customer experience.

Here’s how to decide what your shop should offer—and why a hybrid approach might be the smartest move.

Why Offering Multiple Payment Options Matters

The way people pay for print jobs is changing fast.

The rise of online payments in print shops

- Online payments are now standard—even for B2B print clients

- Customer preferences directly affect how quickly you get paid

- Limiting payment methods = longer AR cycles and slower cash flow

If you’re still relying on checks and “call-in payments,” you’re making it harder for clients to pay—and harder for yourself to grow.

Benefits of ACH Payments for Print Shops

ACH (Automated Clearing House) transfers are direct bank-to-bank payments. For print shops, they come with serious advantages:

Lower Fees for Merchants

ACH transactions typically cost 1/10th of credit card fees. On high-value invoices, that’s real money back in your pocket.

Ideal for High-Value Invoices

If you’re running $5,000+ jobs, ACH makes more sense than eating 2.9% in card processing fees.

Recurring Billing Advantages

ACH pairs perfectly with subscription-style print services—monthly signage packages, retainer clients, or franchise contracts.

Download the Recurring Billing Playbook →

Benefits of Credit Card Payments for Print Shops

Credit cards are the gold standard for convenience—and for many customers, they’re non-negotiable.

Convenience for Buyers

Corporate clients and small businesses love using cards for rewards points, expense tracking, and quick approvals.

Faster Cash Flow

Card payments process in hours, not days—critical for shops needing fast turnover.

Branded Payment Pages with PCI Compliance

With Payably, your shop gets a secure, branded checkout experience that builds trust and keeps you PCI compliant.

🔗 Learn About the Payably Plugin →

Why Not Both? The Hybrid Approach

Here’s the truth: you don’t have to choose.

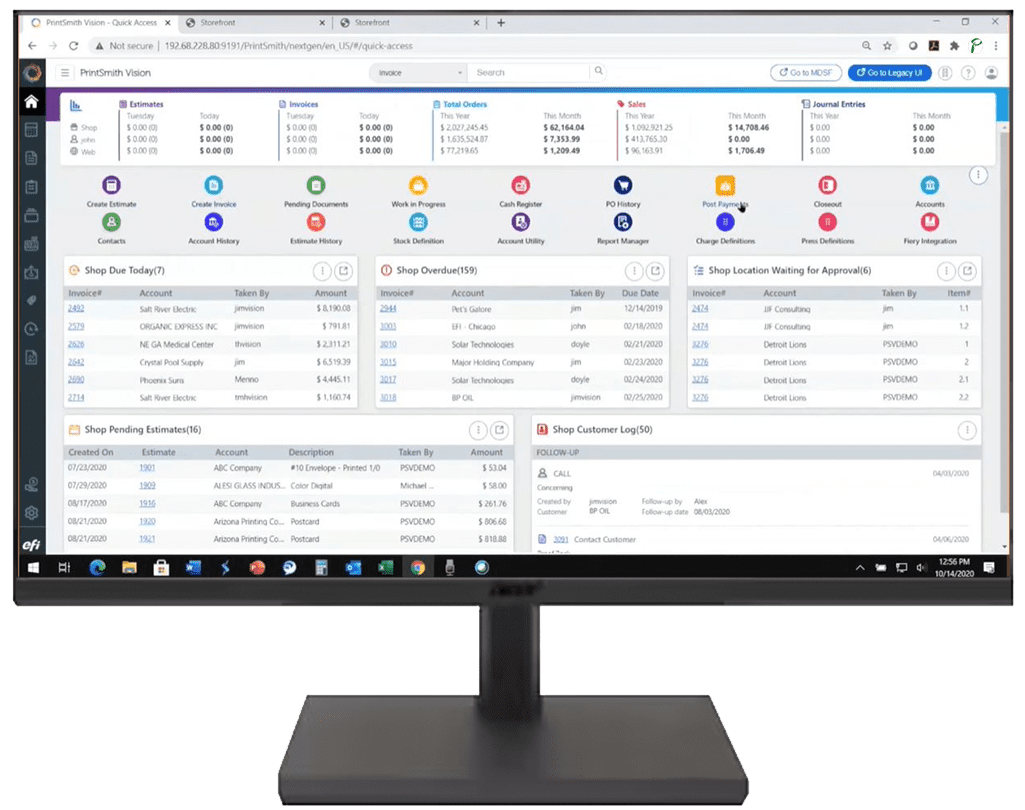

The Payably Plugin for PrintSmith Vision supports both ACH and credit card payments—giving you the best of both worlds:

- Real-time posting to PrintSmith Vision

- Branded, secure payment pages for clients

- Flexible options that meet customer expectations

Whether it’s a $250 flyer job or a $25,000 franchise package, you can get paid faster and smarter.

Ready to Offer ACH + Credit Cards?

Download the Recurring Billing Playbook to learn how flexible payments can transform your shop.

Book a Demo to activate ACH + credit card payments in PrintSmith.