PCI Compliance in 2026: What Every Print Shop Owner Needs to Know

If your print shop accepts credit card payments, PCI compliance isn’t optional—it’s essential for protecting your business and your customers. Here’s what the latest requirements mean for you and how to stay ahead of the curve.

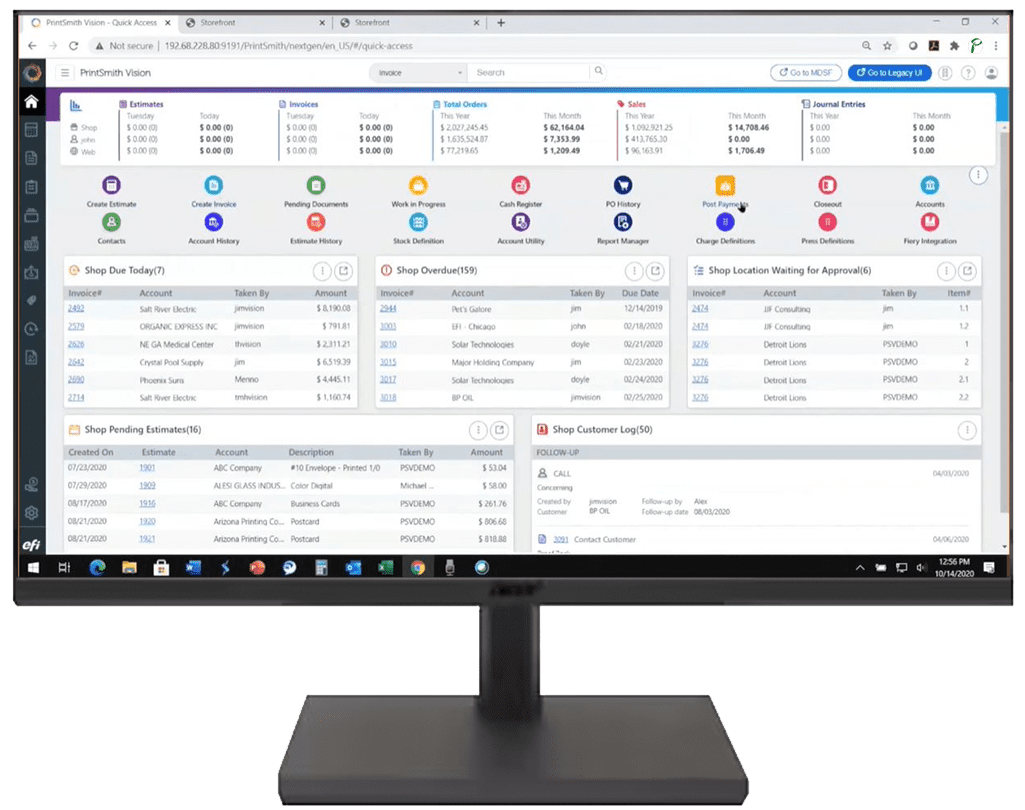

The Payment Card Industry Security Standards Council has rolled out significant updates with PCI DSS v4.0.1, and these changes affect every business that processes card payments—including print shops. Whether you’re running transactions through PrintSmith Vision or accepting payments at the counter, understanding these requirements will help you avoid costly penalties and keep your customers’ data safe.

The good news? You don’t need to become a cybersecurity expert to stay compliant. With the right approach and the right payment partner, navigating these requirements is entirely manageable.

What’s Changed for 2026

The biggest shift businesses are seeing this year is the emphasis on documentation. The new PCI standards require more detailed records of how you protect cardholder data and more evidence that your security controls are actually working.

For print shop owners, this means keeping better records of your payment processes, understanding which systems touch customer payment data, and having clear documentation of your security practices.

Six Steps to Prepare for Your PCI Assessment

- Research each requirement: Understanding what’s expected before you begin prevents confusion and costly mistakes down the road.

- Set clear milestones: Break the compliance process into manageable steps with specific deadlines.

- Map your data flow: Know exactly how customer payment information moves through your business—from the point of sale to your bank account.

- Identify who’s responsible: Determine which team members or vendors are responsible for each system that handles payment data.

- Build in extra time: Unexpected issues arise in every audit. Padding your schedule prevents last-minute scrambling.

- Work closely with your assessor: A qualified security assessor is your guide through the complexities of PCI requirements.

Key Requirements Print Shops Should Understand

While the full PCI standard covers dozens of requirements, several stand out as particularly relevant for businesses like print shops that may not have dedicated IT security teams.

Multi-Factor Authentication Is Now Standard

If you access any system that stores payment data—whether that’s your point-of-sale system, your merchant account dashboard, or integrated software like PrintSmith Vision—you’ll likely need multi-factor authentication. This means using more than just a password: think text message codes, authenticator apps, or biometric verification. The requirements now extend beyond just remote access to include all administrative access to cardholder data environments.

Stronger Password Requirements

Passwords for accounts with access to payment systems must now be at least 12 characters long, and you can’t reuse your last four passwords. If your shop has been using simple passwords or the same ones for years, it’s time for an update. Modern password managers make this easier than ever to implement.

Know Your Service Providers

Every vendor that touches your payment data—from your payment processor to your point-of-sale provider—has PCI responsibilities. The new standards require you to formally review whether each provider is meeting their compliance obligations. You can no longer assume they’re handling things correctly; you need documentation to prove it.

Better Logging and Monitoring

Your systems need to keep records of payment-related activity, and someone needs to actually review those logs for suspicious behavior. For many small businesses, this is where working with a compliant payment processor makes all the difference—they handle much of this monitoring on your behalf.

Why This Matters for Your Print Shop

A single data breach can cost a small business tens of thousands of dollars in fines, legal fees, and lost customer trust. PCI compliance isn’t about jumping through hoops—it’s about protecting the business you’ve built.

E-Commerce Security: A Critical Update

If your print shop accepts online orders with credit card payments, pay close attention to requirements 6.4.3 and 11.6.1. These new standards address one of the most common ways cybercriminals steal payment data: malicious scripts on payment pages.

Here’s the scenario: Your website displays a payment form, either one you host yourself or one provided by a third-party payment service (often displayed in what’s called an “iframe”). Hackers have found ways to inject invisible code into these pages that captures customer card numbers as they’re typed—without you or your customers ever noticing.

The new requirements focus on two key protections:

What These Requirements Mean

- Requirement 6.4.3: You need to know every script running on your payment pages. If you don’t recognize a script, it shouldn’t be there. The goal is to eliminate unnecessary code that could create security vulnerabilities.

- Requirement 11.6.1: You need to be alerted when anything changes on your payment pages—new scripts added, existing code modified, or page headers altered. This early warning system helps catch attacks before customer data is compromised.

For print shops using third-party payment forms, there’s an important clarification: if your payment processor provides the payment form and takes responsibility for protecting it from script attacks, they may be able to satisfy these requirements on your behalf. This is something to discuss with your payment provider—make sure you get confirmation in writing.

Simplifying Compliance with the Right Partner

Here’s what many print shop owners discover: the path to PCI compliance gets significantly easier when you’re working with a payment processor that’s built to handle these requirements.

A compliant payment solution handles much of the heavy lifting—secure data transmission, proper encryption, monitoring for suspicious activity, and maintaining the documentation that auditors require. When payment data never touches your internal systems directly, your compliance scope shrinks dramatically.

This is exactly why integration matters. When your payment processing works seamlessly with your management software, you get the efficiency benefits while minimizing your security exposure. Your customer data stays protected, your compliance burden stays manageable, and you can focus on running your print business.

Planning for Success

Whether this is your first PCI assessment or your tenth, preparation makes all the difference. Start early, document everything, and don’t hesitate to ask questions when requirements aren’t clear.

The businesses that struggle with PCI compliance are usually the ones that treat it as an annual checkbox rather than an ongoing practice. Security isn’t something you do once—it’s something you maintain. Regular password updates, periodic reviews of who has access to what, and staying current with your payment processor’s security features will serve you far better than cramming before an audit.

And remember: you don’t have to navigate this alone. The right payment partner will help you understand your obligations and provide the tools to meet them without disrupting your day-to-day operations.

Your 2026 Compliance Checklist

- Review your current payment flow and document how cardholder data moves through your business

- Update passwords on all payment-related systems to meet the new 12-character minimum

- Enable multi-factor authentication wherever it’s available

- Request PCI compliance documentation from each vendor that handles your payment data

- If you accept online payments, confirm how your payment provider addresses script security requirements

- Schedule your assessment with enough lead time to address any issues that arise

PCI compliance might seem daunting at first glance, but it comes down to fundamental principles: protect customer data, control who has access, monitor for problems, and keep records of what you’re doing. With these practices in place and a payment processor that prioritizes security, your print shop will be well-positioned for 2026 and beyond.

Ready to Simplify Your Payment Security?

Payably provides print shops with integrated payment processing that makes compliance straightforward. One flat fee, seamless PrintSmith Vision integration, and the peace of mind that comes from working with a payment partner that takes security seriously.

Learn How Payably Can Help