Picture this:

It’s 6:47 PM on a Tuesday, and the lights are still on at Maple & Main Printing.

Sarah, the owner, is hunched over a stack of unpaid invoices and a blinking cursor in QuickBooks.

She’s chasing down three clients who “forgot” to pay, correcting an invoice that bounced back with a typo, and trying to remember if that Canva file she sent to production is even print-ready.

She checks her email.

Nothing.

She refreshes her bank portal.

Still nothing.

Meanwhile, her supplier invoice—$4,862.00 due tomorrow—is looming like a thundercloud.

Sound familiar?

You’re not alone. Manual AR is quietly robbing print shops of tens of thousands of dollars every year.

The Real Cost of Manual Accounts Receivable

Manual invoicing feels cheap because it’s “just the way we’ve always done it.” But here’s the math no one tells you:

- Missed invoices: 2–5% of invoices get lost, mis keyed, or simply forgotten in a manual workflow.

- Late payments: Manual follow-ups average 18–25 days slower than automated reminders.

- Labor cost: That 10 hours/week your office manager spends chasing checks? At $25/hour, that’s $13,000/year.

- Cash flow gaps: Every 30 days of delayed cash flow can cost $1,000–$3,000 in lost opportunity or interest.

For a small-to-mid-sized print shop, that’s $50,000 a year in hidden losses.

All because your AR process is stuck in 2008.

Why Manual AR Hits Print Shops Harder

Most industries can afford some delay.

But print? It’s a cash flow knife fight.

- Materials need to be bought upfront.

- Labor is booked per job.

- Margins shrink fast if a single payment slips through the cracks.

And if you’re juggling Canva files, proof approvals, and walk-in customers, AR is the last thing you want to babysit.

Automation Turns Chaos Into Cash

Now, imagine Sarah’s shop—but with Payably in the loop:

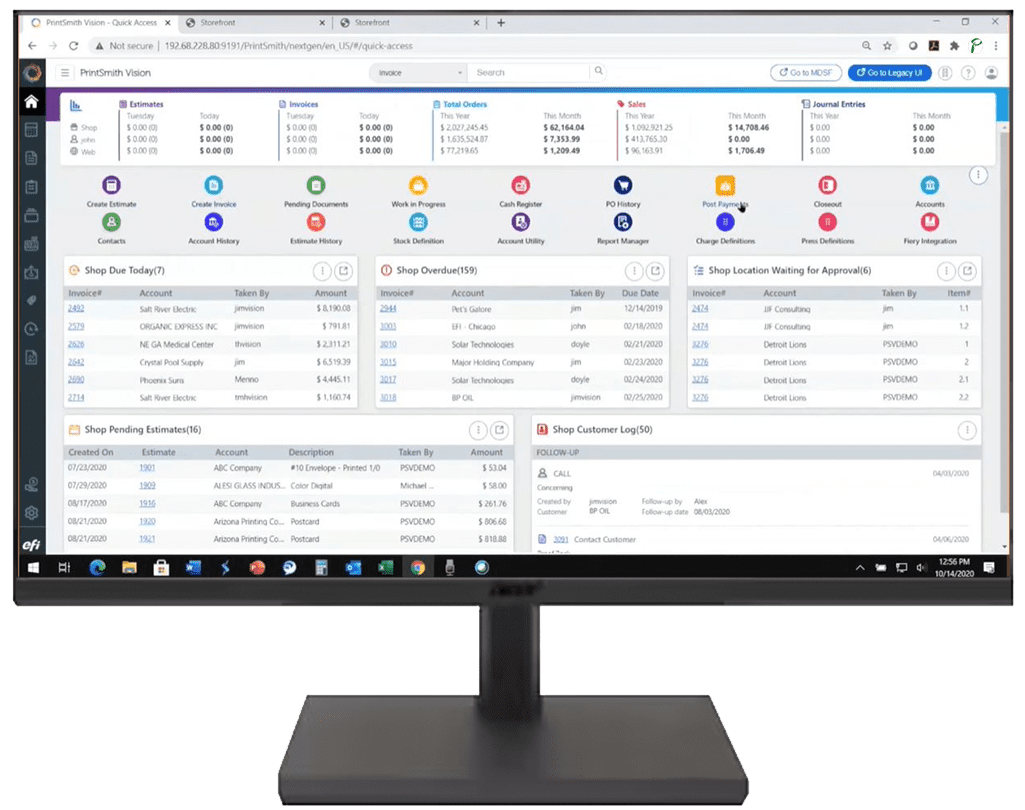

- Invoices send themselves the moment a job closes.

- Branded payment pages make it easy for customers to pay online (credit card or ACH).

- Automated reminders follow up without the awkward phone calls.

- Payments post directly into PrintSmith, no manual double entry.

Suddenly, Sarah isn’t chasing checks.

She’s watching payments hit her account in days, not weeks.

Her cash flow stabilizes. Her stress level drops.

That $50,000 mistake?

Gone.

Your $50K Recovery Plan Starts Here

If you’re still printing invoices, mailing statements, and hoping for the best, the numbers aren’t in your favor.

But they can be.

- Automate your AR.

- Offer payment flexibility (ACH + credit card).

- Get paid faster.

And watch that $50,000 swing back into your pocket where it belongs.

Ready to See It in Action?

Book a Live Demo of Payably and start getting paid faster.

Download the Print Shop Payment Automation Checklist to see exactly how top printers are recovering tens of thousands every year.