The Hidden Profit Leak: Why Process Flow Optimization Matters for Your Print Shop

Business Operations • Payment Automation • Profitability

Every print shop owner knows the feeling. You started this business because you love the craft—the precision of a perfect print, the satisfaction of delivering a finished product that exceeds customer expectations. Yet somewhere along the way, you found yourself spending less time on production and more time chasing payments, reconciling invoices, and managing the administrative chaos that comes with running a small business.

You’re not alone. And more importantly, there’s a better way.

The Real Cost of Inefficient Processes

Walk through a typical day at most print shops, and you’ll find a familiar pattern: jobs come in, estimates get created, work gets produced, invoices go out—and then the waiting begins. Payment delays stretch from days to weeks. Staff members toggle between software systems that don’t communicate with each other. Manual data entry introduces errors that create downstream problems in accounting.

These inefficiencies aren’t just frustrating. They’re expensive.

Consider the math. The average print shop processes roughly 400 jobs per month at about $350 per job—that’s $140,000 in monthly revenue flowing through your operation. When payment collection stretches beyond 30 days, you could have $140,000 or more sitting in accounts receivable instead of your bank account. When your team spends even 15 minutes per day on redundant data entry or payment reconciliation, that adds up to more than 60 hours per year of lost productivity per employee.

For an industry where net profit margins typically run between 1 and 3 percent—with only the top-performing shops achieving 8 percent or higher—these hidden costs can mean the difference between thriving and barely surviving.

Understanding Process Flow Optimization

Process flow optimization sounds technical, but the concept is straightforward: examine every step in your workflow from customer inquiry to final payment, identify where time, money, or accuracy gets lost, and implement systems that eliminate those losses.

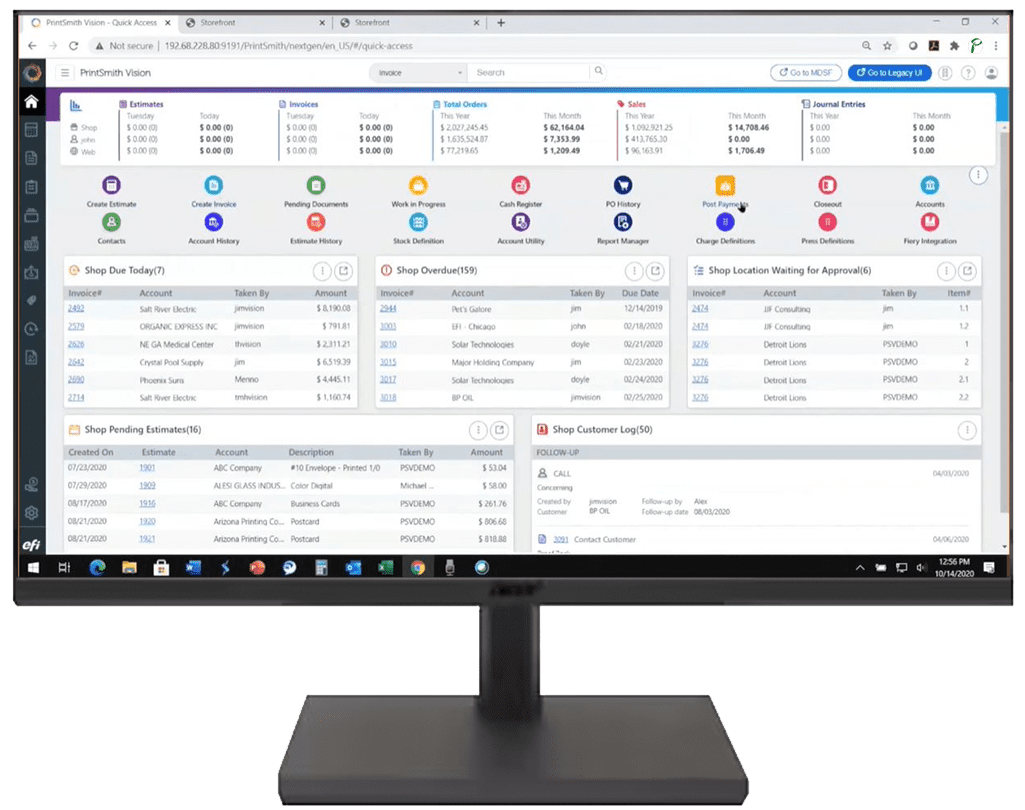

For print shops, this typically involves three interconnected areas: job management, production workflow, and financial operations. While most shop owners have given considerable attention to the first two, financial operations—particularly payment processing—often remains a manual, disconnected afterthought.

This represents a significant missed opportunity. When payment processing operates separately from your management information system, every transaction requires duplicate effort. Customer data gets entered multiple times. Payment status doesn’t automatically update job records. Reconciliation becomes a manual, error-prone process that consumes hours of valuable time.

The Case for Embedded Payment Automation

Embedded payment automation changes this equation entirely. Rather than treating payment processing as a separate function that happens after the “real work” is done, embedded solutions integrate payment capabilities directly into your existing workflow.

What does this mean in practice? When a customer approves a quote, payment terms and processing capabilities are already in place. When a job completes, the invoice and payment request flow automatically from the same system that tracked the job. When payment arrives, your records update instantly—no manual reconciliation required.

The benefits compound throughout your operation.

Ready to Streamline Your Payment Process?

Discover how Payably integrates seamlessly with your print shop workflow to accelerate payments and improve cash flow.

See How It WorksEvaluating Your Current Process

Before implementing any new system, it helps to understand where your current process is costing you money. Consider these questions:

How many days typically pass between job completion and payment receipt? If the answer exceeds your payment terms, you have a collection efficiency problem.

How much time does your team spend each week on payment-related tasks? Include time for creating invoices, sending reminders, processing payments, reconciling accounts, and correcting errors. The total often surprises shop owners.

How many software systems does your financial workflow touch? Each handoff between systems represents an opportunity for delay, error, and inefficiency.

What percentage of your invoices require manual follow-up before payment arrives? High percentages indicate that your current process makes payment inconvenient for customers.

What to Look for in a Payment Solution

Not all payment solutions deliver the same value for print shops. As you evaluate options, prioritize these characteristics:

The Profitability Connection

Every operational improvement ultimately connects back to profitability. For print shops operating on thin margins, payment automation delivers profit improvement through multiple channels:

Taking the First Step

Process improvement doesn’t require a complete operational overhaul. Start by documenting your current payment workflow—every step from job completion to funds in your bank account. Identify where delays occur, where errors enter, and where manual effort adds time without adding value.

Then explore solutions designed to address those specific pain points. The right embedded payment solution for your shop will depend on your current systems, your transaction volume, your customer base, and your growth plans. But the fundamental principle applies universally: when payment processing becomes an integrated part of your workflow rather than a separate burden, your entire operation becomes more efficient.

Your print shop’s profitability depends on countless decisions and actions each day. Don’t let inefficient payment processing quietly drain the margins you work so hard to earn.

Take Control of Your Cash Flow Today

Learn how print shops are getting paid 20% faster with embedded payment automation built specifically for the print industry.

Explore Payably for Print Shops