Don’t Leave Your Print Shop’s Door Unlocked

Why Every Print Business Needs a Fraud Protection Strategy

Here’s something I bet you’ve never thought about: operating your print shop without fraud protection is basically the same as locking up for the night but leaving the back door wide open. Sure, maybe nothing happens the first week. Or the first month. But eventually? Someone notices. And when they do, the damage can be catastrophic—the kind that keeps you up at night wondering if you’ll recover.

The better news is this doesn’t have to be your story. With smart planning and the right tools in place, you can shut that door before the bad guys even know it exists.

of companies lose more than $10 million annually to fraud

expected to be lost to online retail fraud from 2023 through 2027

of merchants report rising online fraud

Look, Fraud Happens. It Just Doesn’t Have to Happen to You

Let’s be honest—you didn’t open a print shop to become a cybersecurity expert. You’re great at what you do. Custom designs, tight deadlines, happy customers walking out with perfect business cards or that massive banner they needed yesterday. That’s your wheelhouse.

Nobody expects you to also track the latest payment fraud schemes or know the difference between a bot attack and friendly fraud (though we’ll get to both in a minute). That’s actually the whole point. You shouldn’t have to be an expert in something that’s completely outside your business model. But ignoring it? That’s where things get dicey.

“Even if you master the fraud trends of today, six months down the road, it’s an entirely new conversation. Fraud evolves quickly, and keeping up with it is challenging.”

Why Print Shops Make Such Juicy Targets

Think about your typical Tuesday. You’ve got someone ordering 500 wedding invitations online. Another customer rushes in needing same-day posters for a conference. A repeat client emails about a big banner order they need shipped across the country by Friday. You’re processing credit cards all day long—some in person, plenty online, maybe even through your mobile setup.

Every single one of those transactions? It’s a potential entry point for someone trying to game the system.

Here’s what we see happening to print shops specifically: Thieves use stolen credit cards to order high-value items—think expensive large-format prints or bulk orders—then arrange for quick pickup or rush shipping before the real cardholder even notices the charge. Sometimes they hack into your existing customer accounts (that’s called account takeover) and place orders that look completely legitimate because, well, they’re coming from real customer profiles.

Then there’s “friendly fraud,” which is possibly the most frustrating kind. A customer places a legitimate order, gets their products, uses them for their event or whatever they needed them for, and then files a chargeback claiming they never received the order or the quality was poor. Your shop is out the product, the money, AND you get hit with chargeback fees.

And don’t even get me started on bot attacks. Criminals use automated programs to test thousands of stolen card numbers through online ordering systems, and if your site doesn’t have protections in place, you become their testing ground.

This Is Where Payably with FraudSight Changes Everything

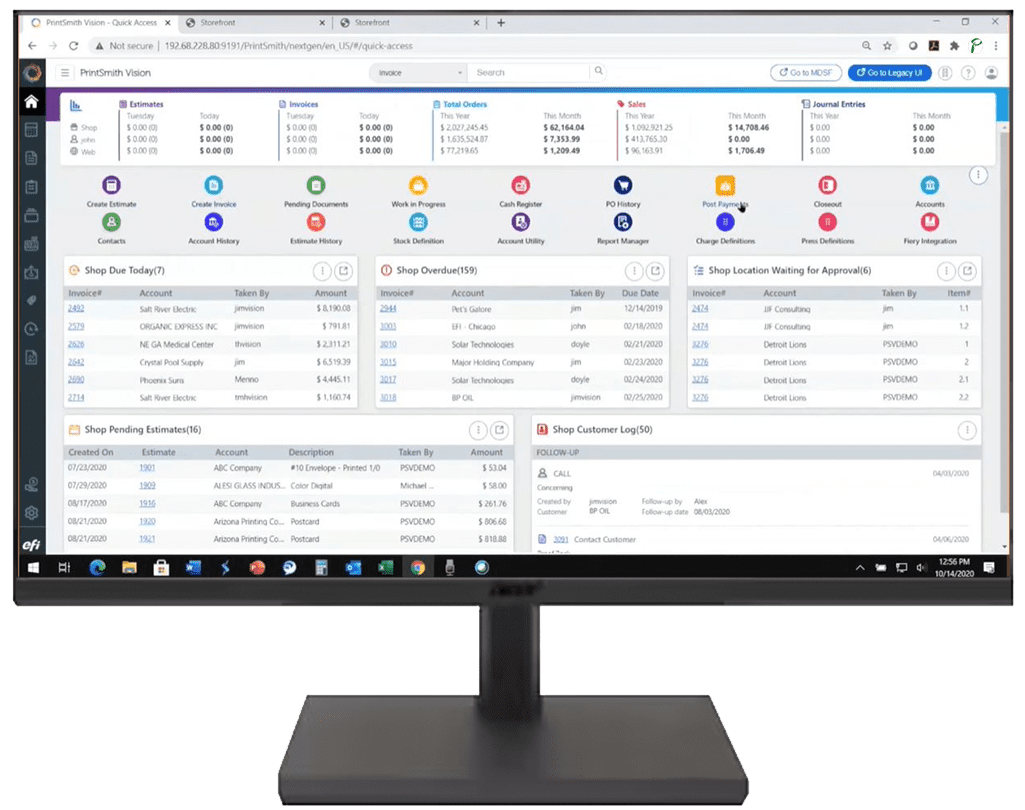

We’ve built something pretty remarkable into our payment platform. It’s called FraudSight, and it’s basically like having a team of security experts watching your transactions 24/7, except you never have to hire anyone, train anyone, or even think about it after the initial setup.

The system works in layers—four of them, actually—and they all run simultaneously in the background while you’re doing, you know, actual print shop work.

Here’s How It Protects You

This is your first line of defense. Before fraud even gets close to your checkout page, gateway-level shields are already blocking massive attack attempts. Think of it as a bouncer who stops trouble at the door.

Remember those bots we mentioned? This layer stops them cold. It also prevents account takeovers by adding smart security that doesn’t annoy your real customers but definitely frustrates hackers.

This is where things get really interesting. The system analyzes 40+ billion transactions every year, learning patterns and spotting suspicious behavior in real time. It catches fraud before the transaction even completes. No complicated setup required on your end.

Actual human fraud specialists are constantly monitoring emerging threats and adjusting your protection. They’re adapting your defenses faster than the fraudsters can adapt their tactics.

What This Actually Means for Your Day-to-Day Operations

You Stop Losing Good Sales: Ever had a legitimate order get declined for “suspicious activity”? Frustrating, right? FraudSight’s intelligence actually increases approval rates because it’s better at distinguishing between real customers and thieves. Your good customers sail through checkout, fraudsters get stopped.

Chargebacks Drop Dramatically: When fraud gets caught before the transaction processes, you’re not dealing with chargebacks weeks later. Those chargeback fees add up fast, not to mention what they do to your processing rates over time.

Zero Headaches on Setup: I’m serious about this one. FraudSight integrates with Payably’s platform automatically. You’re not spending hours configuring settings or watching tutorial videos. It just works from day one.

Enterprise-Grade Tools Without the Enterprise Price Tag: Small businesses typically can’t afford the kind of fraud protection that big corporations use. But FraudSight runs on data from billions of transactions—the same tech Fortune 500 companies rely on—at a price point that makes sense for a print shop.

Works Everywhere You Do Business: In-store sales, online orders, mobile payments—doesn’t matter. Every transaction gets protected the same way, across every channel you use.

You’ve Got Enough on Your Plate Already

Can we just acknowledge how busy you are? Between managing inventory, dealing with suppliers, handling customer revisions, keeping equipment maintained, and actually running the business side of things… when exactly are you supposed to become a fraud prevention expert too?

You’re not. That’s the whole point.

Here’s the thing most business owners don’t realize until it’s too late: recovering from a major fraud incident isn’t just about the money you lose on that one transaction. It’s the time you spend dealing with your bank, filing reports, fixing your systems, losing sleep wondering what else might be compromised. For a small business, that kind of disruption can be absolutely crippling.

Prevention is exponentially easier—and cheaper—than cleanup. Always.

FraudSight operates as a fully managed solution. You get an entire fraud prevention team backing your business without hiring a single additional employee or becoming an expert yourself.

Keep Your Focus Where It Belongs

Your goals are pretty straightforward, right? Run a successful print shop. Keep your customers happy. Protect your business and your reputation. Make sure people can pay you easily without any weird friction in the process.

A solid fraud strategy with Payably and FraudSight checks every one of those boxes. Your payment processing stays smooth and seamless. Your legitimate customers never notice the protection (which is exactly how it should be). And the fraudsters? They hit a wall and move on to easier targets.

The protection scales with you too. Whether you’re processing your first hundred transactions or your hundred thousandth, the system adapts and grows alongside your business.

Don’t Be the Shop That Waited Too Long

Fraud isn’t some abstract possibility anymore. It’s happening right now, every day, to businesses just like yours. The real question isn’t whether fraudsters will try to hit your print shop—they will—but whether you’ll be ready when they do.

Lock your doors. Protect what you’ve built. Let Payably with FraudSight handle the security while you handle the printing.

Ready to Protect Your Print Shop?

Join thousands of businesses that trust Payably for secure, seamless payment processing with enterprise-level fraud protection built in.

Learn More About Payably + FraudSight