In the bustling, deadline-driven world of print and sign shops, technological upgrades often focus on the visible: faster presses, better substrates, sharper finishing. But some of the most impactful innovations happen behind the scenes, often overlooked yet profoundly transformative—especially when it comes to payments.

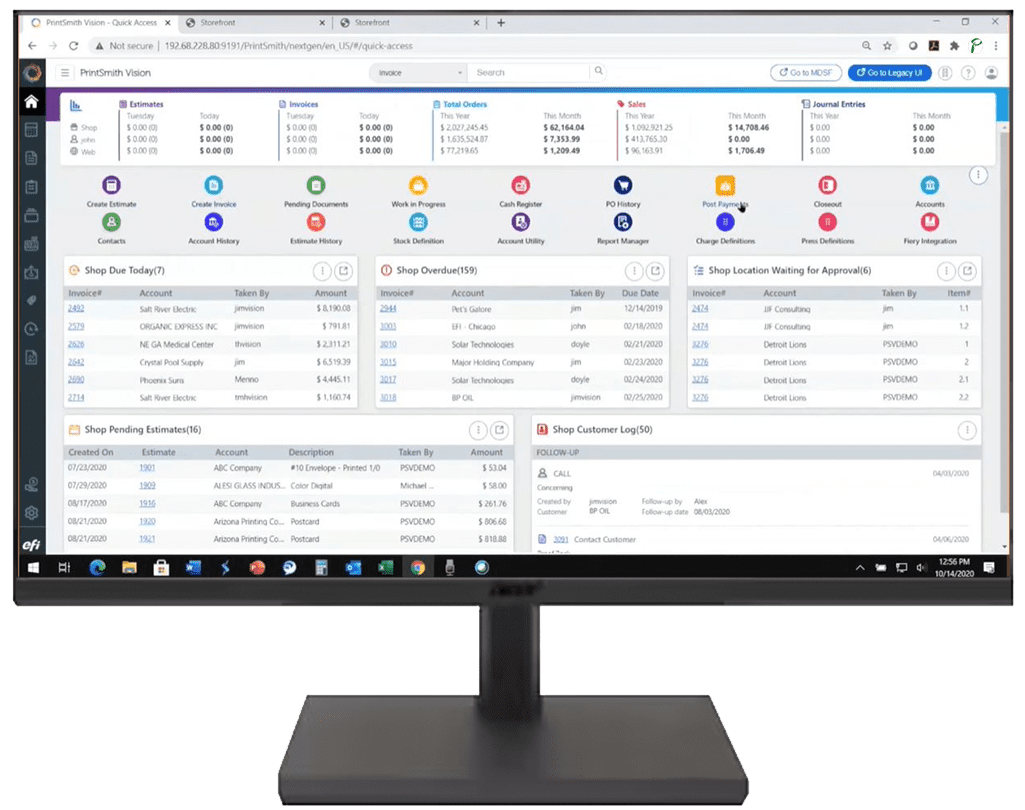

As the print industry continues to digitize, one area is finally getting the attention it deserves: the modernization of payment processes. For print shops using MIS platforms like PrintSmith Vision, the opportunity to modernize payments is clearer than ever.

The Hidden Bottleneck in Print Production

Most business owners wouldn’t dream of managing jobs or inventory with spreadsheets anymore. Yet, payments—arguably the lifeblood of the business—often remain manually handled, siloed, or outdated.

Paper checks. Manual reconciliation. Delayed invoices.These processes cost time and quietly erode margins. In a sector where speed, efficiency, and customer service are top priorities, traditional payment methods can slow everything down.

Customers Expect More—And Faster

Modern customers, whether B2B or B2C, have shifted their expectations. According to research by Deloitte, 73% of business buyers expect a B2C-like experience, especially around transactions (Deloitte, 2019). That means digital invoices, self-service payment portals, and real-time confirmations are no longer perks—they’re expected.

These expectations extend to the print world, where clients are juggling multiple vendors and timelines. Giving them a seamless, transparent payment experience not only improves satisfaction—it increases the likelihood of faster payment.

Automation Is More Than a Buzzword

Automation in payments isn’t about replacing people—it’s about refocusing them. When payment systems talk to job management software, when transactions post automatically, and when reconciliation is handled in real time, your staff gets back hours of productive time each week.

Imagine the difference when your team doesn’t have to chase invoices, manually log transactions, or cross-check payment reports at the end of every month. The gains aren’t just in efficiency—they’re in morale, accuracy, and scalability.

Payment Trends Worth Watching

Several trends are reshaping how small and mid-sized print businesses approach payment processing:

Embedded Payments in Workflow Tools

As more shops adopt industry-specific platforms like PrintSmith Vision, they benefit from tools that embed payments directly into operational workflows—eliminating the need to toggle between systems.

Digital-First Invoicing

Email-based invoicing with real-time payment links is reducing turnaround time on receivables. According to PYMNTS.com, digital invoicing shortens payment cycles by up to 40% compared to traditional methods.

Recurring and Scheduled Payments

For clients with ongoing needs—think franchise signage, recurring promotional materials, or monthly reorders—scheduled billing reduces friction for both parties and creates predictability in cash flow.

Integrated Financial Reporting

Payment platforms that sync with accounting software and job management systems are reducing end-of-month reconciliation time dramatically. Automation here reduces human error and simplifies tax preparation.

Enhanced Security & Compliance

As security requirements increase, many print shops are re-evaluating their payment ecosystems. PCI compliance, tokenization, and role-based access controls are now standard expectations, not just enterprise features.

Cash Flow: The Quiet Hero of Resilience

Efficient payment processes don’t just improve operations—they create financial stability. With rising material costs, tighter deadlines, and growing competition, having predictable, timely cash flow is what keeps print shops nimble and resilient.

Modernizing the payment lifecycle—from quote to invoice to transaction to reconciliation—has become a competitive advantage. Shops that streamline this journey unlock capital faster, reduce administrative burden, and position themselves for growth.

It’s Time to Think Strategically About Payments

Print and sign shop owners are experts at logistics, creativity, and customer relationships. But in today’s climate, payments need to be seen not as an afterthought, but as a core business function that directly impacts profitability.

When payments are integrated, automated, and customer-friendly, they don’t just “happen” faster—they contribute actively to a healthier, more efficient business.

Closing Thought

The future of print is not just faster presses or bolder colors. It’s smarter systems, quieter efficiencies, and invisible upgrades that free your team to focus on what matters. As the industry continues its digital evolution, payment automation may not make headlines—but it’s already transforming the backbones of successful print operations everywhere.